E-111: ASEAN Fintech Shows Remarkable Resilience In 2024

Southeast Asian fintech startups raised US$1.4 billion between January and September 2024.

The Asian fintech industry has proven to be one of the most resilient globally amid the downturn.

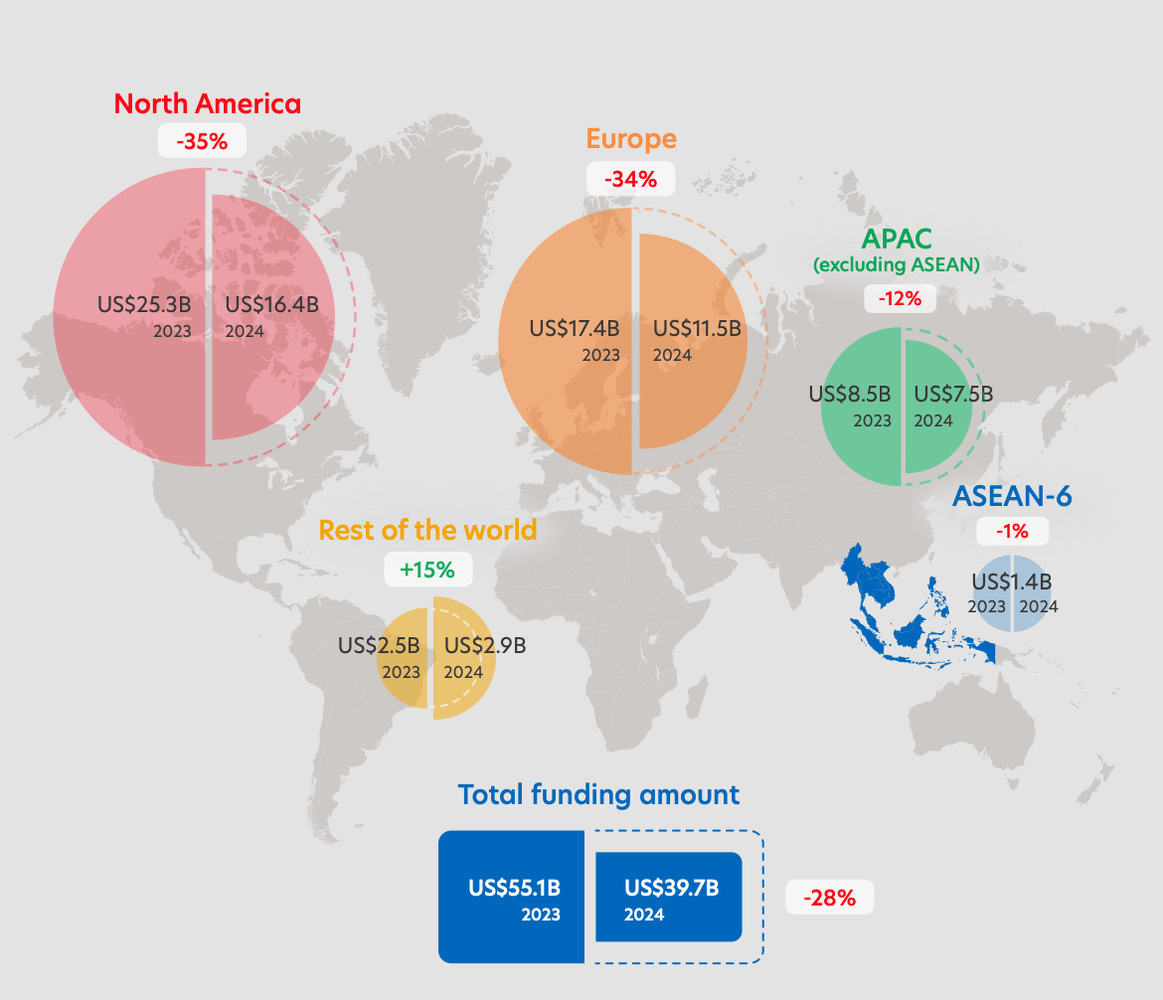

In the first three quarters of 2024, global fintech funding declined 28% to US$39.6 billion, per a recent report by PwC, UoB, and the Singapore Fintech Association. At the same time, fintech funding in North America and Europe fell by more than 35% as inflation and geopolitical concerns persist.

On the other hand, ASEAN-6—Singapore, Indonesia, Malaysia, Thailand, Vietnam, and The Phillippines—saw a marginal drop of 1% year-on-year in fintech investments in the first nine months of 2024, highlighting the region’s resilience and stability. In total, Southeast Asian fintech startups raised US$1.4 billion between January and September 2024.

Early-stage investments (pre-seed to Series B) made up more than 60% of total fintech funding in the region. Interestingly, it included two large Series A funding rounds— GuildFi (US$140 million) and Longbridge (US$100 million).

The fact that investors are willing to invest in innovation at the foundational level, is potentially due to the promise of future returns. Consequently, ASEAN continues to be a breeding ground for new fintech ideas which is a sign of long-term health, the report notes.

A confluence of factors is at play: The region still has a large underbanked population. At the same time, it is witnessing a rapidly expanding middle class. Then, the region also has a massive pool of young people who are tech-savvy and increasingly affluent.

This bodes well for the fintech startups, giving them a large market base to test their solutions.

Notably, wealth tech saw a rise in investor interest. In the first nine months of 2024, Southeast Asian wealth tech startups closed 41 deals, surpassing traditional categories such as lending and e-payments, according to data collated by DealStreetAsia.

Singapore attracted US$745 million or over half of ASEAN’s total fintech funding and the highest number of deals in the 9M 2024. Thailand ranked second, surpassing Indonesia, with US$341 million.

Together, Singapore and Thailand accounted for 76% of regional funding in 2024, with four mega-deals between them. Indonesia dropped to the third position this year, witnessing a drop in its share of the funding pie with no mega deals.

Overall, ASEAN fintech funding has surged over tenfold since 2015, the report notes.

Now that the US central bank, the Federal Reserve, has begun slashing interest rates, it is expected to potentially revive venture capital interest.

The next phase of the regional fintech growth is likely to be driven by the combination of emerging technologies—blockchain, Gen AI, and quantum computing—which have immense potential on their own to transform the fintech landscape.

The combination of these three technologies will potentially push the boundaries of financial services, offering solutions that are faster, more secure, and more intelligent than ever before, as per the report.

For example, Gen AI’s ability to detect and predict fraudulent patterns, coupled with blockchain’s immutable ledger, can help reduce fraud risks in real-time transactions. Similarly, quantum computing can enhance encryption, enabling quantum-resistant cryptographic techniques that secure blockchain networks against future threats.

Another emerging key fintech trend in the region is green finance, driven by both global and local demand. Regulators and businesses have already started embracing initiatives to align financial growth with sustainability goals.

On that note, let’s dive into this week’s recap.

Buzzing Deals

➤ Singapore-based logistic company Portcast raised US$6.5 million in Series A funding. The investment was led by Susquehanna Asia VC. Hearst Ventures, and Signal Ventures. Existing investors including Wavemaker Partners, TMV, and Innoport also chipped in. Portcast enables logistics companies to improve profitability through dynamic demand forecasting and real-time vessel and container tracking. The company plans to use the funding to advance its AI technology, providing real-time insights and recommendations and expand operations in the Asia Pacific and European markets.

➤ Philippines-based prop-tech startup NoneAway received US$1 million in the pre-seed funding round to enhance real estate transparency. Its backers included Kaya Founders, Wavemaker Partners, Forge Ventures, and Vulpes Ventures. Notable entrepreneurs including Jani Rautiainen, co-founder of PropertyGuru, and ER Rollan, co-founder of GrowSari also pitched in. NoneAway operates a platform that connects verified property owners, seekers, and licensed brokers, ensuring secure and efficient transactions with two-factor authentication. The company aims to eliminate duplicate listings and allow users to create and share personalized property lists.

➤ Malaysian robotics company DF Automation & Robotics (DF Auto) secured US$1.85 million in a fresh funding round led by Vynn Capital to support its growth plans. Existing investor Malaysian Technology Development Corporation (MTDC) and new investor Japan’s Leave a Nest Capital also participated. Established in 2012, DF Auto specializes in designing and manufacturing autonomous mobile robots (AMRs). These self-navigating robots can automate intralogistics across industries like semiconductor manufacturing, automotive, electronics and electrical, food and beverage, aerospace, and healthcare services.

➤ Singapore-based digital logistics firm Locad netted a US$9 million pre-series B round co-led by Global Ventures and existing investor Reefknot Investments. Sumitomo Equity Ventures, Antler Elevate, Febe Ventures, and JG Summit also participated in this funding round. Locad is the logistics engine enabling e-commerce brands to systematically store, pack, ship, and track orders across Asia-Pacific, GCC, and the USA. It syncs inventory across online channels and organizes end-to-end order fulfilment. With the new funding, the company aims to enhance Locad’s AI-driven logistics capabilities and support international expansion plans.

➤ Singapore-based startup Oneteam bagged US$2.6 million in seed funding led by Wavemaker Ventures, aimed at transforming succession planning for small and medium-sized enterprises through employee ownership. It aims to bridge this gap by acquiring businesses from retiring owners and over time, transitioning them into employee-owned entities. Oneteam plans to allocate approximately 70% of the new funding to acquiring small businesses.

➤ Singapore-based consumer financing platform Atome obtained a US$200 million syndicated credit facility from HSBC’s ASEAN Growth Fund. A part of Advance Intelligence Group, one of the largest technology startups based in the city-state, Atome Financial offers shoppers flexible payment solutions at popular online and offline retailers is popular for its buy now, pay later services. It serves over 20 million users and partners with 3,000 merchants, including global brands like Sephora and Zara. The new fund will boost Atome Financial’s lending services and the expansion of its Atome card in Singapore, Malaysia, and the Philippines.

➤ Japan and Malaysia-based farm-to-table startup Secai Marche raised an additional 250 million yen (around US$1.6 million) in its series A funding round. This investment entails equity contributions from Mitsui Sumitomo Insurance Venture Capital and debt from The Shizuoka Bank and The Hokkoku Bank. Launched in 2019, Secai Marche is a B2B online platform for farmers and chefs for trading and food distribution services. It offers 4,000 fresh products to businesses and consumers. The funds will help Secai Marche expand in Southeast Asia's e-commerce and food and beverage sectors.

What Stood Out This Week

➤ Australian VC firm Boman Group is launching a US$1 billion fund to back firms based in China. It is close to completing the first phase of a new fund. Over the past two years, the company acquired the necessary licenses to operate in China. Founded in 2011 and previously known as BMYG Financial Group, Boman Group has US$600 million in AUM. This fund also aims to support Australian start-ups with the potential to enter the Chinese market. It has a plan to open offices in Tianjin, with the possibility of expanding to locations near Shanghai and in southern China.

➤ Chinese auto giant BYD plans to invest 100 billion yuan (US$13.8 billion) in developing AI-based intelligent automotive technologies. The company recently celebrated its 30th anniversary. To date, it has produced 10 million new energy vehicles, becoming the first EV manufacturer globally to reach this milestone. Additionally, BYD plans to develop the fourth phase of its industrial park in the Shenzhen-Shanwei Cooperation Zone, to reach an annual output value exceeding 200 billion yuan (US$27.6 billion).

➤ Apple Inc. plans to invest around US$100 million in Indonesia over two years, following a government ban on selling its iPhone 16 model in the country. The country’s regulations require manufacturers to source 40% of components locally. Initially, Apple wanted to invest approximately US$10 million in accessory and component production in Bandung, Indonesia, but that didn’t help much. Even though the iPhone maker commands only 2% smartphone market share, its shipments have been growing annually at a double-digit rate. The iPhone sales are projected to hit 2.9 million units this year, up from 2.1 million in 2023.

And that’s the wrap for this edition of #ICYMI. Every week, we recap the latest developments in the Southeast Asian startup ecosystem, along with a commentary on what catches our eye.